Understanding HVAC Insurance Cost Factors

If you are running a business in the HVAC industry, having proper insurance coverage is crucial to protect your business from unforeseen risks. The cost of HVAC insurance varies based on a number of factors. Here, we will discuss some of the main factors that influence HVAC insurance costs.

Business Size

The size of your business is one of the main factors that determine your HVAC insurance cost. Generally, small businesses with fewer employees and less revenue will have lower insurance costs compared to larger businesses. This is because smaller businesses are perceived to be at lower risk than larger businesses, which have more employees and generate higher revenue.

Location

The location of your business is another important factor that affects HVAC insurance cost. If your business is located in a high-risk area such as a flood zone, crime-prone area, or an area prone to natural disasters, you will likely pay more for insurance. This is because the risk of damage or loss to your business is higher in these areas.

Type of Coverage

The type of coverage you choose will also affect your insurance cost. The more coverage you have, the higher your insurance premium will be. However, having adequate coverage is important to protect your business from all potential risks. Some of the essential coverage options for HVAC contractors include general liability, workers' compensation, and professional liability insurance.

Experience and Qualifications

Your experience and qualifications as an HVAC contractor can also impact your insurance cost. Contractors with higher levels of experience and qualifications are perceived to be at lower risk of accidents, property damage, and injuries. This can result in lower insurance costs as insurance companies offer lower premiums to experienced and qualified contractors.

Claims History

Your claims history is another critical factor that insurers consider when determining your HVAC insurance cost. If you have a history of frequent claims and losses, you may be perceived as a high-risk customer, and you will need to pay higher insurance premiums to secure coverage against potential risks. On the other hand, if you have a clean claims history, you can benefit from lower insurance costs as insurers consider you to be a lower risk customer.

Equipment and Material

The equipment and material used by HVAC contractors can also affect insurance cost. If you work with high-end equipment and materials, it will raise your insurance costs since repairing or replacing such equipment or material in case of loss or damage can be expensive. Thus, the value and quality of equipment and materials used in your business will impact your insurance expenses.

Conclusion

Understanding these factors can help you determine your HVAC insurance cost and prepare yourself for the expenses. While the insurance cost may vary from one business to another, having the right coverage is important to protect your business from potential risks and liabilities.

Types of HVAC Insurance Policies Available

Running an HVAC (Heating, Ventilation, and Air Conditioning) business can be a lucrative and profitable venture, but it's not without its risks. There are many risks associated with HVAC installations and maintenance, and even the most experienced and competent professionals can make mistakes. These mistakes can result in serious accidents, property damage, or lawsuits. That's why it's essential to have an insurance policy that covers all these risks. There are several types of HVAC insurance policies available, and business owners should choose the one that best suits their needs.

General Liability Insurance

General liability insurance is a type of policy that provides coverage for accidents or injuries that occur on the business premises, such as a client slipping and falling or damage to a client's property. This policy provides coverage for medical expenses, legal expenses, and property damage caused by accidents and mishaps involving the HVAC business. A business owner can choose the limits of coverage that they need, depending on the size and nature of their business.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, provides coverage for damages or injuries caused by mistakes or negligence on the part of an HVAC professional. If a client sues an HVAC business, claiming that they didn't do the job properly or caused damage to their property, professional liability insurance can provide coverage for legal fees, settlement or judgment amounts, and other related expenses.

Professional liability insurance is particularly crucial for HVAC contractors, as working with heating and air conditioning systems can have many moving parts and intricate dynamics. A business owner should choose coverage limits based on their needs and the risks associated with the work they do.

Commercial Property Insurance

Commercial property insurance protects the HVAC business owner from financial losses due to damage to the business property. This coverage applies to buildings, equipment, and inventory, and provides for repairs or replacement in the event of damage or destruction. Covered events include fire, theft, vandalism, and natural disasters such as floods or storms.

It's essential to note that commercial property insurance policies do not cover damage due to wear and tear or neglect. A business owner should choose coverage limits based on the value and location of their business property, as well as the risks associated with their area's weather or natural disasters.

Workers' Compensation Insurance

Workers compensation insurance is a type of policy that provides coverage for employees' medical expenses, lost wages, and rehabilitation expenses related to work-related injuries or illnesses. If an HVAC employee gets injured while on the job, workers' compensation insurance can provide coverage for their medical expenses and related expenses. This can also protect the business owner from lawsuits related to workplace accidents or injuries.

It's essential to note that workers' compensation insurance is mandatory in most states, and business owners can face hefty fines or legal penalties if they don't have proper coverage. A business owner should consult with their insurance provider to determine the coverage limits required in their state and industry.

Conclusion

Insuring an HVAC business is essential to protect against risks and hazards associated with the work. Each type of policy provides a different type of coverage, and business owners should choose the one that best suits their needs. It's also crucial to work with a reputable and experienced insurance provider to ensure that the chosen policy will provide adequate coverage in the event of an accident or loss.

Factors Affecting Your Business' HVAC Insurance Costs

As mentioned earlier, there are several factors that will determine your HVAC insurance costs. Three of the significant factors affecting your HVAC insurance costs are:

1. Business Size and Operations

The size and scope of your business will significantly affect your HVAC insurance costs. This is because the more extensive your business operations, the more risk you face, and hence the higher the insurance premiums. Factors that insurance providers will consider when assessing your business operations include the size of your workforce, the range of services you offer, the number of vehicles you own, and the types of HVAC systems you install, maintain, or repair. Larger HVAC companies with more employees, services, and equipment on the job site will have higher premiums than smaller companies.

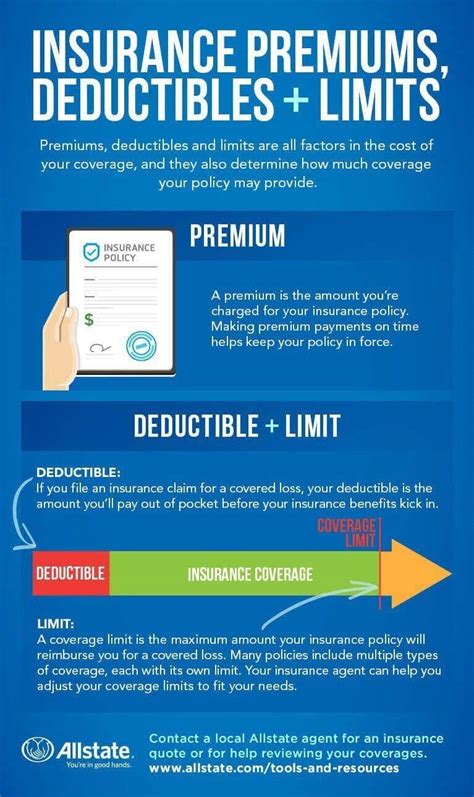

2. Insurance Coverage Limits and Deductibles

The insurance coverage limits and deductibles you choose will also affect your HVAC insurance costs. Coverage limits refer to the maximum amount an insurance policy will pay out for a covered loss, while deductibles refer to the amount you pay before your insurance coverage kicks in. Generally, higher coverage limits and lower deductibles will result in higher insurance costs, while lower coverage limits and higher deductibles have lower costs. Your insurance agent or broker can help you determine the best coverage limits and deductibles for your business's unique needs, so you're not paying for more coverage than you require.

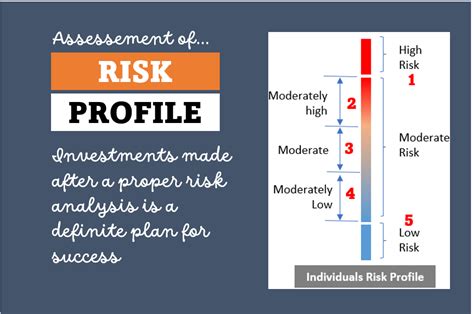

3. Industry Risk Profile

The risk profile of your industry is the level of risk associated with your business operations. The HVAC industry has several risks related to the installation, maintenance, and repair of HVAC systems. For instance, there is the risk of physical harm or property damage resulting from accidents on the job site, damage to customer property during HVAC system installation or repair, or environmental risks related to the use and disposal of hazardous materials. The higher the risk profile of your industry, the higher your insurance premiums will be. Your insurer will consider the level of risk associated with your business operations when determining your insurance premiums. This is another important reason why you should have insurance to protect your business from the risks associated with HVAC operations.

Conclusion

When it comes to HVAC insurance cost, there are several factors to consider before buying a policy. As a business owner, you need to understand the factors affecting your HVAC insurance costs, and consider the best options for your unique needs. By discussing your business operations and risks with your insurance agent or broker, you can get a better idea of the coverage limits and premiums that are right for you. Being adequately insured can give you peace of mind, knowing that your business is protected in case of any accidents, property damage, or lawsuits.

Choosing the Right HVAC Insurance Policy for Your Business

As an HVAC contractor, it's crucial to have the right insurance to protect your business and livelihood from potential risks and liabilities. HVAC insurance can provide coverage for property damage, bodily injury, and equipment breakdowns. However, choosing the right insurance policy can be a daunting task for business owners. Here are some key factors to consider when selecting the right HVAC insurance policy for your business:

1. Determine Your Coverage Needs

The first step in choosing the right HVAC insurance policy for your business is to determine your coverage needs. Every business has different risks and liabilities that require different types and levels of coverage. In general, HVAC insurance policies should provide coverage for the following:

- General liability insurance to cover property damage, bodily injury, and personal injury

- Worker's compensation insurance to protect employees injured on the job

- Business property insurance to provide coverage for any damage to your equipment and tools

- Commercial auto insurance to cover any vehicles used for business purposes

- Errors and omissions insurance to protect your business against claims of negligence or mistakes made by your employees

Take the time to assess your business's specific needs and risks to ensure you have adequate coverage.

2. Shop Around

Once you have determined your coverage needs, it's important to shop around and compare policies from different insurance providers. Don't just settle for the first policy you come across. Instead, research and compare policies and prices from multiple providers to find the best fit for your business.

3. Check the Insurance Company's Reputation

Before selecting an insurance provider, be sure to check their reputation and customer service. You can do this by researching online reviews and ratings, checking with your state's insurance department, and asking for referrals from other contractors or business owners.

4. Consider Policy Limits and Deductibles

When selecting an HVAC insurance policy, it's essential to consider the policy limits and deductibles. Policy limits refer to the maximum amount an insurance provider will pay out for a claim. Deductibles are the out-of-pocket expenses you pay before the insurance coverage kicks in. It's essential to choose limits and deductibles that are both affordable and adequate for your business's needs.

In addition, some insurance providers offer umbrella policies that provide additional coverage beyond the standard policy limits. These policies can be beneficial for businesses with higher risk and liability factors, but they may come with higher premiums.

Conclusion

Choosing the right HVAC insurance policy for your business is critical to protecting your livelihood and assets from potential risks and liabilities. Carefully assess your coverage needs, shop around and compare policies from different providers, check the insurance company's reputation, and consider policy limits and deductibles to determine the best fit for your business.

By taking these steps, you can ensure that you have the right coverage and protection to keep your business running smoothly and avoid potential financial losses.

Tips for Lowering Your HVAC Insurance Costs

If you're a HVAC contractor, you need insurance to protect your business, workers and clients. Unfortunately, the cost of insurance can be prohibitive, cutting into your profits and making it difficult to stay competitive. However, there are ways to lower your premiums while still getting the coverage you need. Here are a few tips:

1. Compare Multiple Quotes

One of the easiest ways to lower your HVAC insurance costs is to shop around and compare quotes from multiple insurance companies. Different carriers have different rates, so getting multiple quotes can help you find the most affordable coverage. Be sure to compare the coverage limits and exclusions, as well as the premiums, to make an informed decision.

2. Opt for a Higher Deductible

Another way to lower your insurance premiums is to opt for a higher deductible. The deductible is the amount you pay out of pocket before the insurance coverage kicks in. By choosing a higher deductible, you can lower your monthly premium payments. However, be sure you can afford to pay the higher deductible if you need to file a claim.

3. Maintain a Safe Workplace

Insurance companies assess risk when determining premiums. One way to reduce your risk profile and lower your insurance costs is to maintain a safe workplace. This means providing safe working conditions for your employees, including proper training, safety equipment, and hazard prevention measures. A safe workplace can reduce the chances of accidents or injuries, which results in lower insurance rates.

4. Invest in Liability Prevention

Liability claims can be expensive, causing your insurance rates to skyrocket. Fortunately, you can reduce the risk of liability claims by investing in prevention measures. This includes maintaining records of proper training for employees, requiring appropriate safety equipment and procedures, and having a protocol for handling and filing complaints. Taking these measures shows your insurer that you are proactive in preventing liability claims and can lower your premiums.

5. Bundle Your Policies

If you have multiple insurance policies, such as general liability, workers compensation, and commercial auto coverage, consider bundling them with the same provider. Many insurers offer discounted rates when you bundle your policies with them. Bundling your policies not only saves you money but also makes managing your policies easier.

Lowering your HVAC insurance costs requires some time and effort on your part, but it can pay off in the long run. By comparing quotes, opting for a higher deductible, maintaining a safe workplace, investing in liability prevention, and bundling your policies, you can lower your premiums and protect your business at the same time.